What Entrepreneurs Can Learn From The ABSA Group

If you fall into the category of growth-oriented entrepreneurs, there’s no doubt that you constantly brainstorm ideas of how you can grow your business and increase revenue. In this week’s strategy case study, I share key things I have learned about how ABSA creates value for its 12.2 million clients across 16 countries.

Company History

ABSA is a premier pan-African bank, driven by a strong desire to serve and create value for its diverse stakeholder groups around the world. As a financial institution, they focus on empowering and enabling by investing in their employees, uplifting communities, and supporting their clients' ambitions. ABSA’s core values are trust, resourcefulness, courage, stewardship and inclusion. Absa Group was established in 1986 with the incorporation of Amalgamated Banks of South Africa (ABSA) Limited, resulting from a merger between United Building Society Holdings South Africa, Allied Bank South Africa, Volkskas Bank Group, and certain interests of the Sage Group1. By income, ABSA is the 3rd largest bank in South Africa2.

Financial Overview

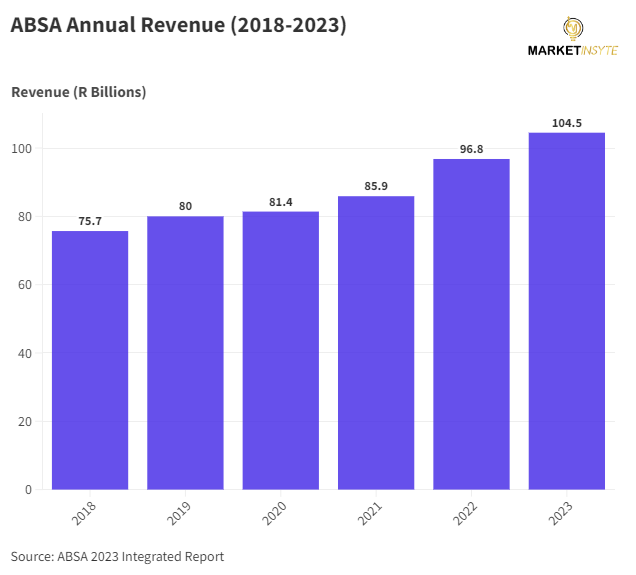

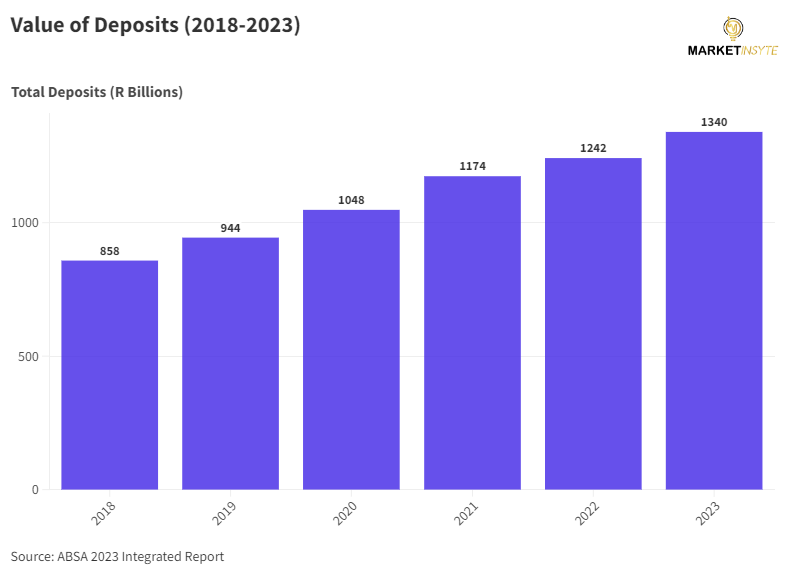

ABSA’s financial performance over the past five years has been commendable given the tough economic conditions it has operated in due to geopolitical tension and disruptions.

ABSA’s revenue increased at a 7% Compound Annual Growth Rate (CAGR) between 2018 to 2023. Although this was lower than expected, it reveals that ABSA’s financial performance was resilient amid the pandemic and other external shocks. It also shows that the Group came out of the post-separation phase (from Barclays) stronger than before: between 2018-2020, the Group gained R5.7 Billion in revenue compared to R15.4 Billion between 2020-20223. Furthermore, in 2023, ABSA’s retail and corporate clients deposited over R1.3 Trillion- approximately 1.6 X more than deposits in 2018.

Strategy Overview

A good strategy is founded on a clear vision of where you want to take your business, purpose, and decisive actions. While studying ABSA, it became clear that the company is strong on vision and purpose. ABSA’s purpose is “Empowering Africa’s tomorrow, together ... one story at a time” and its vision is to become the leading Pan-African bank. It is all well and good to establish a purpose and vision for your business but without clear objectives and actions to take you there, that vision will not be realised. Founders are visionaries so they often don’t take long to get vision and purpose for their enterprises but they falter when it comes to developing strategies to turn their visions into reality. ABSA, and other successful businesses, can serve as a blueprint to help you formulate growth strategies for your business. Let’s look at ABSA’s key strategic objectives for the next few years.

A diversified franchise with deliberate, market-leading growth: ABSA’s first priority is to expand into high-growth markets across Africa by leveraging international partnerships, organic growth and acquisitions. The reason for this is to diversify revenue streams and mitigate market-related risks prevalent in certain countries.

The primary partner for our clients: ABSA is focused on building brand loyalty because it wants to be the main partner for its clients. ABSA provides solutions to various segments such as low-income clients, high-net-worth individuals, SMMEs and large corporations therefore this objective requires the provision of client-centric value propositions that foster customer satisfaction and brand loyalty. In line with this objective, ABSA delivered over R1 Billion in benefits to its clients last year through its price transformation strategy. Furthermore, ABSA introduced a Free Rewards program in 2023.

A digitally powered business: Technology is transforming the banking industry and disrupting traditional business models. ABSA has been taking significant strides towards becoming a digitally powered business and its goal is to become a ‘digitally powered bank with a complementary physical presence’. ABSA uses technology in every area of its business- from empowering its workers to decision-making and enabling clients to use digital banking services. Advancements aligned with this objective include its peer-to-peer solution- ABSA Card Send and partnerships with startups.

A winning, talented and diverse team: Aware of the integral role employees play in the business’ growth, culture and organisational health, ABSA plans to invest heavily in employee development. The new pillar of ABSA’s employee development and engagement strategy is the ABSA eKhaya Colleague Share Scheme through which employees can own a share of ABSA.

An active force for good in everything we do: This objective is all about increasing ABSA’s social impact. Investments in the following 3 core areas will be used to achieve this: climate change, financial inclusion, and inclusivity and diversity.

Principles for Early-Stage Entrepreneurs

Determine what factors affect your business’ growth prospects: Just like ABSA is aware of the internal and external factors that affect its growth, so should you. Whether you are a solopreneur or a founder of a billion-dollar startup you need to be aware of the factors that hinder or foster growth.

Search for new customer segments: A good way to foster growth is to create solutions for different types of consumers. For example, ABSA has different types of accounts and benefits for young people, SMMEs, large corporates, and High Net Worth Individuals. ABSA also operates in 16 different countries. It is never too early to formulate strategies for entering new markets and launching new products/services. If you currently only have young customers, what is your plan for reaching a new demographic? If you only have one product line, what new products can you launch in the future?

Establish your business’ purpose: Why does your business exist? This is one question that caused a seismic shift in the way I think about business and I know it ultimately fuels growth. The foundation of ABSA’s strategy is purpose, it should not be different for your business. Why should customers do business with you? Why is it important to solve the problem your business is tackling? These are just a few questions you should answer to unearth the purpose of your business and formulate strategies based on the answers.

Align actions with each business objective: It is important that your strategies include objectives and actionable steps. If your objective is to create new product lines, what is your product roadmap? If your objective is to develop your team, what initiatives will you implement?

Wikipedia

BankFocus

ABSA 2023 Integrated Report